Saving for Millennials: The Harsh Truth!

A Millenial’s Guide to Saving the Fuck Up!

Millennials are born between the years 1981 and 1996. Most of them believe in living fully and are conscious of their appearance and lifestyle standards. This makes them inclined towards spending money on things that aren’t necessary but make them look good among their peers in a bid to “fit in”. Part of the problem is that we receive little to no financial advice from our elders because they couldn’t figure it out themselves! It’s high time that Millenials stop making the mistakes that their previous generations made, and start saving smartly!

If you relate to being broke by the end of the month, read on!

Usually, a millennial would describe savings as “Savings = Income – Expenditure” because that’s what we’ve been taught. But the most successful people stand by a different formula altogether, which says “Expenditure = Income – Savings”

In simple words, there are 2 ways to make money: 1) By working hard and smart, which everyone should do. And 2) By saving! After you follow the first way and work for money, you follow the 2nd way and make money work for you! Allocate a certain % of your salary into an SIP, or a mutual fund, or an FD, and do it AS SOON AS YOU RECEIVE your salary! That way, you limit your expenditure to whatever you have left, and have the satisfaction and security of saving!

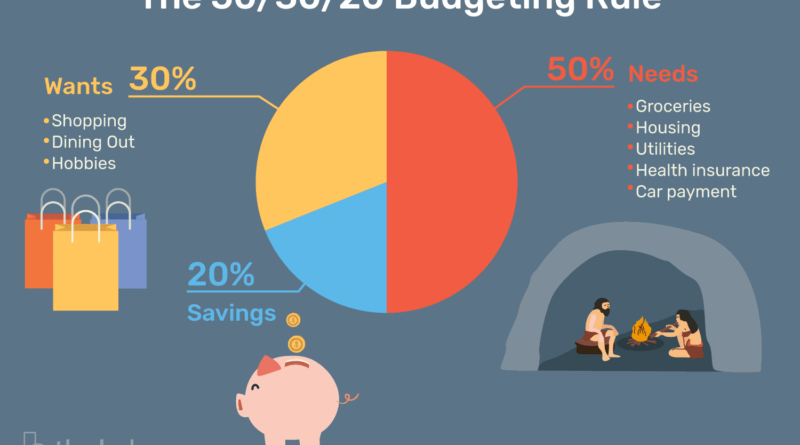

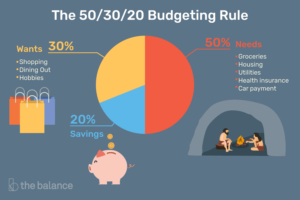

Adopt the 50-30-20 rule.

The most financially adept people stand strongly by this rule! This rule tells you to spend 50% of your income to needs, 30% to your wants and 20% to savings! This rule is also in close correspondence to the above tip. These two steps are the smartest way to invest and save money for a secure future!

Live below your means.

I know, I know! How can you be a millennial if you don’t spend lavishly? You NEED to have the latest iPhone and those limited edition sneakers! But these urges are your biggest hurdle towards a financially smart life. These luxury items are the things that you buy from the 30% that you reserve for your wants! You should not let them eat into your needs, nor should they affect the 20% that you save. If you spend the same amount of money every year, but your income increases, that just means that you save more annually! The money that you invest each year into FDs and stocks, generates more money by the end of the year, which in turn generates even more money next year! Your money literally multiplies while you sleep! Living below your means is the only way to achieve this!

Start small.

Alright, what can you do NOW to start saving? It’s very simple. Instead of having 2 cups of Starbucks each day, have one! Avoid eating out and cook your own food! Limit “expensive” excursions with your friends to once or twice a month. It’s also a great excuse to get rid of that cigarette addiction! Wake up early and travel by public transport instead of an Uber! Small acts like these will literally save you upwards of 1 lakh rupees a year, and nothing worthwhile comes easy!

Think long term.

We need to break out of our mold of “living to the fullest each day”. I’m sorry but ZNMD was a lie! You can only say those things when you have tons of savings, and I’m sure Hrithik Roshan had a lot! Life isn’t short. It’s actually really long, and competition to survive is fierce. The only way you can be financially independent is to start saving now! You will thank yourself 5 years or 10 years from now. Plan and make long term investments. Don’t look to earn money “quickly”. Look to earn money “smartly”.

Absorb more financial info.

Read books, watch videos, and listen to podcasts that make you financially aware and interest you to learn more and more about earning and saving money. If possible, look for a mentor to guide you! Our recommendations are Rich Dad Poor Dad, a book by Robert Kiyosaki (there’s a summarised, animated version here. Rachana Ranade on YouTube and Honestly by Tanmay Bhat. The world of finance is very exciting as long as you have good teachers like these!

Financial planning is among the thousands of things that the previous generation has ruined for us. They are used to spending unnecessarily, taking big loans for materialistic things, and spending years paying them off, forcing them to forever carry the burden of debt. This debt ties them down to a job in order to pay the EMIs back, offering little to no time or flexibility to even enjoy the things they brought with the loan! They spend their entire lives working for money, instead of making their money work for them. Millennials need to put an end to this bad habit. Remember, a debt-free life is a stress-free life!